UK government announces plans to increase company size thresholds from October 2024

Melanie Richardson

16/05/2024

In May 2023, the Department for Business and Trade issued a call for evidence to gather views on the UK’s framework for non-financial reporting. Part of the call for evidence centred around reporting thresholds, both company size and company type. The number of categories a company can fall into has increased steadily over time and it has become a complicated aspect of the non financial reporting framework to navigate.

The UK government has announced plans to lay legislation before Parliament this summer to increase by 50%, the monetary thresholds that determine company size, with an intended effective date of accounting periods beginning on or after 1 October 2024. This article considers some of the implications of that announcement.

The Companies Act 2006 sets out four size regimes which drive the specific content requirements of the accounts that need to be prepared and filed with Companies House. Both qualitative and quantitative criteria determine when a company is entitled to report under a particular regime, with the quantitative criteria often referred to as ‘company size thresholds’. The four sizes of company to consider are:

- micro-entity;

- small;

- medium-sized; and

- large.

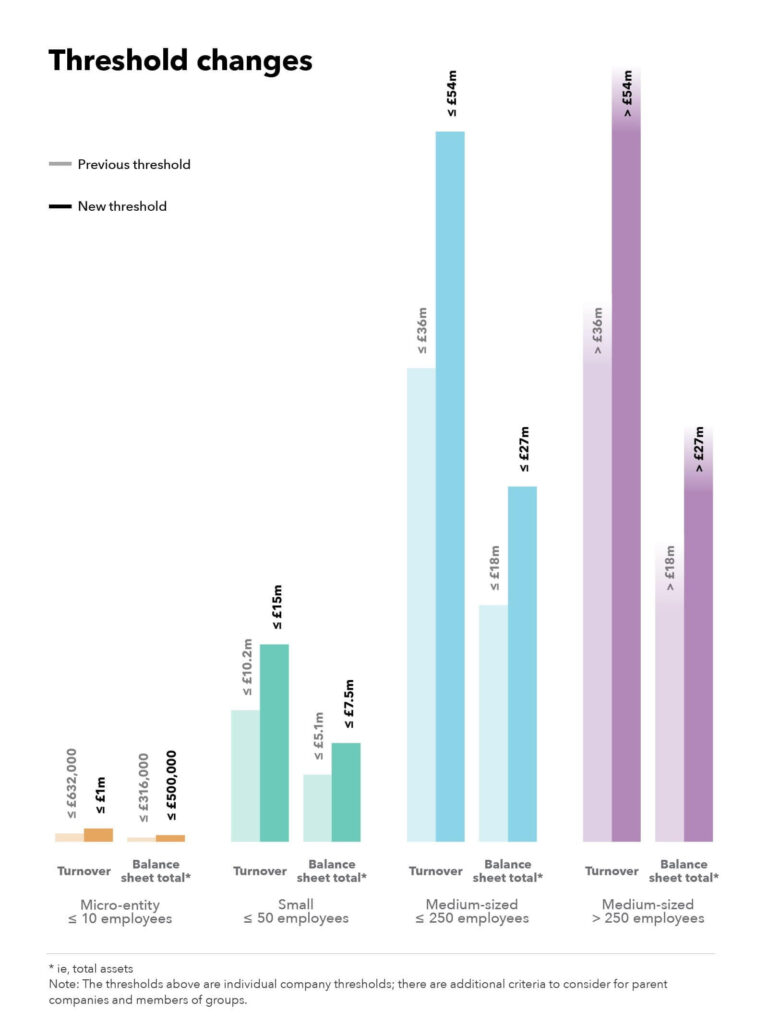

The existing and planned new quantitative criteria are set out in the diagram below. Companies must meet at least two of the three criteria in either their first ever financial year or for two consecutive financial years to be able to qualify for each regime.

As well as the quantitative criteria, qualitative factors are used to establish whether a company is excluded from a regime because of its nature or because it is a member of an ineligible group. For example, public companies and certain financial services companies are not entitled to apply the micro entities, small or medium sized regimes, regardless of meeting the relevant quantitative criteria.

Proportionate reporting requirements

Proportionality is apparently a key feature of the UK’s reporting framework, with a number of special provisions in the Companie Act for micro entities, small and medium sized companies when preparing and filing their annual accounts and reports. The uplift in thresholds will potentially enable companies to move down a size category and take advantage of the accompanying reduction in requirements.

This may seem advantageous, however, for companies on an upwards growth trajectory, any step down in the regime they qualify for may be temporary. Where companies already have processes in place to meet certain reporting requirements, it might prove disruptive to change reporting processes, only to have to reinstate them again in a few years’ time.

What will this mean for my company?

In short nothing yet, if and once the changes take place and your company is moving thresholds, this will have an impact on your reporting requirements. We will be keeping an eye on the situation and advise accordingly. If you have any questions or queries please get in touch with your Swindells partner who will be able to help.

Sign up to receive our private content

straight to your inbox