The increase in Employer’s National Insurance in April 2025

Melanie Richardson

06/02/2025

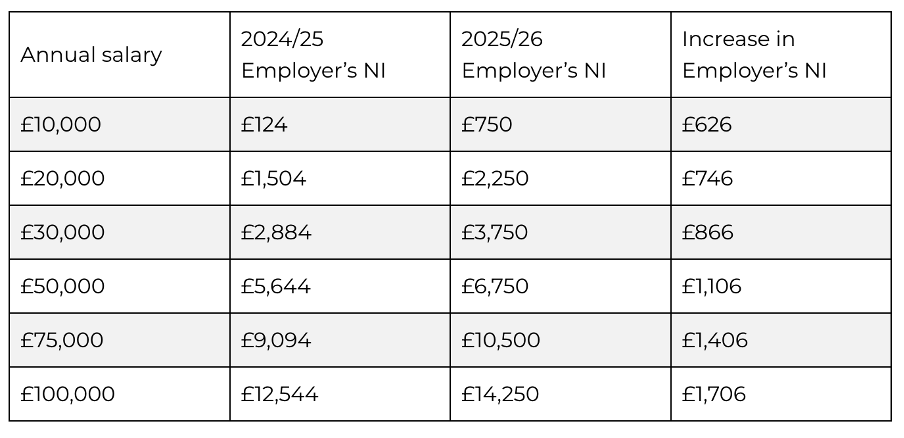

A key measure from the recent autumn budget was the announcement that employer’s national insurance (NI) will increase from 13.8% to 15% from 6 April 2025.

In addition to the increase in rate, the threshold at which employers start paying NI on their employees’ salaries will fall from £9,100 to £5,000.

These changes will result in higher NI contributions for most employers, making it essential for businesses to understand and plan for the financial impact.

Below is a table illustrating the rise in employer’s NI contributions at various salary levels following the new changes:

Can the increase in employer’s NI be mitigated?

The chancellor also announced that the employment allowance will increase from £5,000 to £10,500 from 5 April 2025. This means that eligible employers will essentially receive a credit of £10,500 on their national insurance bill. For businesses with a small number of employees on lower salaries, this increase in the allowance may fully offset any rise in NI costs.

Employers have to claim the allowance each year. Those who haven’t yet made a claim are able to backdate claims for up to four years, potentially resulting in reclaims of up to £20,000.

Historically, employers with NI costs of more than £100,000 were unable to use the employer’s allowance. This cap has now been removed.

Business can also implement salary sacrifice schemes for items such as pension contributions or electric vehicle schemes. In these arrangements, employees agree to sacrifice part of their salary in exchange for benefits. The sacrificed portion is not subject to income tax or National Insurance, thereby reducing both the employee's and employer’s National Insurance contributions.

Lastly while it may offer little immediate comfort, employer’s NI contributions are an allowable expense for corporation tax and income tax purposes. This means businesses will receive tax relief within their year end corporation tax or partnership tax return. The relief rate will vary between 19% and 25% for companies and 20% to 45% for partnerships, depending on profit levels.

If you have any questions about how the National Insurance changes will affect your business, please get in touch with your Swindells partner who will be able to advise you further.

Sign up to receive our private content

straight to your inbox